Developing a Trading Strategy for Unstable Markets: Krypto Trading Guide

Margin Trading Platforms and Other Innovative Tools. However, as with any investment strategy, there are raisks. One of the biggest challenges is to move in unstable markets that can quickly turn profit into loss.

In this article, We will explore key principles, risk Management Techniques and strategies to reafeve risk associated with high volatility markets.

Understanding Unstable Markets

Before developing a trading strategy for unstable markets, it is crucial to understand what makes them so unstable. Lowing Market is Charmacterized by:

.

- Limited liquidity : Quantities of trading can be low

- Risk of losses : High volatility markets often lead to greater potential losses.

Key Principles for the Development of Unstable Market Trading Strategy

Trading a trading strategy for unstable market trafficking in the crypto -valuta, keep in mind the following key principles:

- Diversification : Spread your investments in multiple crypto currency and asset class to raise risk.

- Position size : set the real stops and goals of grinding based on the size of your position.

.

- Trend following : look for trends price, but be aware that even the strongest trends can turn quickly.

Risk Management Techniques

To Alleviate Risks Associated with High Volatility Markets, Consider These Risk Management Techniques:

- Position size : set the real stops and goals of grinding based on the size of your position.

- Stopping orders loss

: set up stops to stop at a fixed price or percentage below the input price to limit potential losses.

3.

- Impact Management : Consider using influence (eg 2x or 3x) to enhance gains, but be aware of increased risk.

Trend of Next Strategies

Cryptocurrency Prices:

1.

2.

.

- Be aware of market feelings : follow the mood of the market and adjust your strategy accordingly.

Example of Trading Strategy

Here’s an example of a trading strategy for unstable markets:

1.

- Choose a crypto currency with a strong trend in favor of you.

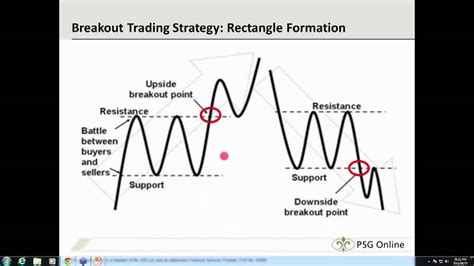

- Identify key support and resistance levels using technical indicators.

4.

- Adjust the stop order because prices move to your advantage.

Conclusion

Developing a Trading Strategy for Unstable Markets in the Cryptocurrency Store Requires Careful Consideration of Key Principles and Risk Management technique.