How Investment Revenue Assessment In Cryptory Currency

The world of cryptocurrency has exploded over the last ten years, and new coins and cuffs begin every day. Although many investors have entered the market with high expectations of wishes and returns, reality is often much more complicated. Because of so much uncertainty and volatility of cryptocurrency investments, it can be difficult to distinguish a signal from noise and make well -founded investment decisions.

In this article, we will look at how investment income is evaluated in the cryptocurrency and provide you with a comprehensive guide to navigate in the market.

Investing in understanding of cryptocurrency

Before we immerse the evaluation techniques, we first understand what the cryptocurrency investment is. Cryptocurrencies are digital or virtual currencies that use encryption for safety and decentralized management. They work independently from central banks and governments and allow users to send them, receive and replace them directly without necessary.

Investment in cryptocurrencies can be performed on the pockets of transmission accounts and individual objects. Each platform has its own rules, rewards and requirements for retaining purchasing, sales and encryption.

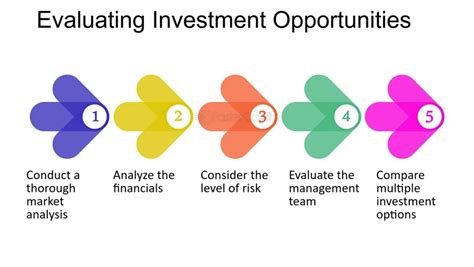

Investment Revenue Assessment: Step -by -step instructions

Follow the following steps to evaluate investment income in cryptocurrency:

- Set your investment target : Before you place your cryptocurrency, it is important to define the investment objectives. Looking for short -term winnings or long growth? Do you want to diversify your portfolio or focus on a particular investment class?

2 Investigate ::

* Blockchain technology

: Understand how it works and the underlying infrastructure.

* Development Group and Consultant : Check whether the development team is experienced, credible and transparent about their goals.

* Market value : Compare the market value of different cryptocurrencies to understand the scope of the market.

- Assessment of Technical Indicators : Technical indicators can provide valuable views on the price, trends and volatility of encryption currency. Some popular technical indicators are:

* Mobile Average : Average prices over a certain period (eg 50 days, 200 days).

* Relative strength index (RSI) : Measure the speed and change of price changes.

* Bollinger Ligaments : consists of two standard deviations and a mobile average.

- Analysis of Market Emotions : Market feelings may indicate the value of the cryptocurrency of investors’ trust. Analyze:

* Trend lines

: Plotlines with potential purchase or sales signals.

* Support and Resistance Level : You recognize the areas where prices usually jump or break.

- Evaluate the amount of liquidity and trading : Liquidity measures the simple purchase and sale of currency, while trading is indicated by market operations. Request:

* High Liquidity : Low standard deviation and high trading volumes can indicate more stability.

* EXCEPTIONAL NUMBER: Increased trading levels can mean an increasing interest in cryptocurrency.

- Evaluate risk tolerance : Placing the cryptocurrency is a significant risk. Evaluate your risk tolerance by evaluation:

* Volatility : Understand how much you lose with every store or you are ready.

* Fear and greed factors : Note the emotional prejudices that can promote investment decisions.

- Review of Alternative Meters : In addition to financial indicators, you should take alternative methods to estimate cryptocurrency returns, eg b.:

* Network Effects : Evaluate the value of the encryption currency based on network size and user growth.