Understanding of basins: Liquidity and honey basins explained in cryptocurrency

Cryptocurrencies have become more and more popular over the years, many people jumping on Bandwagon to invest in digital currencies such as Bitcoin, Ethereum and others. However, as the market continues to grow, as well as the complexity of cryptocurrency trading. A key appearance that has achieved significant attention in recent times is liquidity and honey basins.

In this article, we will deepen in the world of groups, explaining what they are, how they work and why they are essential for traders who want to maximize their yield.

What are the basins?

A group refers to a group of investors who bring together their funds to invest in various assets, including cryptocurrencies. In the context of cryptocurrency trading, groups are used as a way to increase liquidity and reduce risk.

Imagine -you have $ 10,000 to invest in Bitcoin or Ethereum. You could put everything in the game, but this comes with high risks, especially if the market experiences significant price fluctuations. There comes a pool. By joining forces with other investors, you can create a group of users who collect collectively in the same asset.

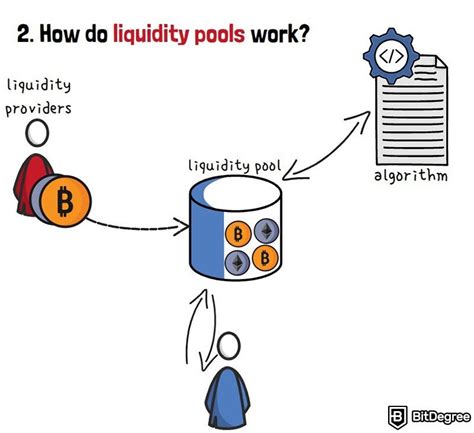

How do the basins work?

Groups work using advanced algorithms to manage collective funds and distribute them between participating members. This process is called liquidity provision. When you join a group, you agree to share your investment with other members, then use that common capital to buy assets.

Here is an example of how it works:

- ** Member

- Warehouse : The pool manager collects the funds from all the members, ensuring that they are safe and in accordance with the regulatory requirements.

- Liquidity disposition : The group uses its own algorithms to allocate the shared capital between the participating members based on market conditions, liquidity and other factors.

- Active acquisitions : Use your portion of the shared capital to buy assets in the pool portfolio.

Types of pools

There are several types of groups available, each having their own advantages and disadvantages:

- Staking Pool : A station basin is a type of pool that rewards users to keep their coins on the platform for a long time. The more time you spend, the greater your yields.

- Liquidity pool

: A liquidity basin is a type of swimming pool that offers low volatility assets, such as stablecoins or chips with low capacity. These basins are designed to provide liquidity on specific markets and can be used for trading purposes.

- Arbitration pool : An arbitration pool is a type of pool that uses algorithms to exploit price differences between two exchanges or platforms. The pool manager collects the profits from these transactions and redistributes them among the participating members.

Group benefits

Poles offer more benefits including:

- Liquid increase : By collecting funds with other investors, groups can increase the liquidity available on the market.

- Reduced risk : Collection allows you to spread your risk on multiple assets, reducing the impact of any market or lowering the market.

- Improved return : Groups use advanced algorithms to optimize yields, ensuring that your investment is aligned with market trends.

Staking bivols

A type of swimming pool that has gained significant attention in recent times is to move the pools. These groups reward users because they held their coins on the platform for a long time, offering a way to win profitability without buying or selling directly active.

To participate in a pool, follow these steps:

- Join a handling basin

: Look for basins that align with your investment goals and risk tolerance.

- Deposit funds : Deposit the coins in the pool wallet.

3.