Cryptocurrency Sales Art with Psychology: Best Decision Deleting

In the world of cryptocurrency trade, emotions play an important role in decision -making. The market can be unpredictable and volatile, so it is challenging to move through unspecified times. However, by understanding trade psychology, you can develop a more conscious approach to risk management and maximize income. In this article, we go to the world of psychological trade in the world and give advice on how to use people’s behavior to make a better decision.

Trade Psychology

Studies have shown that people guided emotions that can have a significant impact on our decision -making processes. Here are some key psychological views to consider:

1

Failure : People tend to fear losses more than benefits, causing excessive trust and impulsive decisions.

- Confirmation Breeds : We tend to find information that confirm our perception without leaving conflicting evidence.

3

Impact anchor : Our original market price assessment can affect our future judgments, which makes it difficult to adapt to the underlying information.

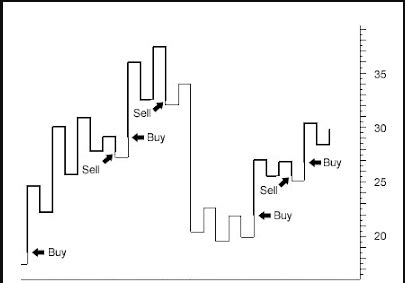

Psychological Trade Technology

You can use the following psychological methods to overcome these cognitive bias and more conscious trade decisions:

- Break -Breeding Regulations : A clear degree of suspension to limit any losses and avoid emotional decisions.

- Risk Management : Your versatile portfolio to reduce market or active exposure by reducing one trade.

3

Cost Average : In order to avoid the risks of time and to avoid emotional decisions.

- Emotional Infection : Identify when others around you trade in certain ways and by adjusting your strategy accordingly. For example, if friends or colleagues are constantly buying bitcoin, this may be a sign that the price is due to adaptation.

- ** Messages based on market and market news and action to make more conscious decisions, but avoid short -term market movements.

Case Study: A successful trade with psychological insights

Think about an example of a cryptocurrency retailer Tom, who constantly made better decisions through psychological methods:

- Before each store, Tom set a clear interruption based on his risk management strategy.

- He used average dollar costs to regularly invest in cryptocurrency, regardless of market functioning.

- In the store with news -based funds, such as Bitcoin, Tom waited before making a decision when he had a careful idea of the underlying information.

tips to improve commercial psychology

Try these tips to open all your potential in a cryptocurrency retailer:

- Develop emotional management

: Identify when emotions affect decisions and take action to control them.

- Be aware, but not too : Follow market news and information while retaining objectivity and avoiding emotional reactions.

3

Practice caution : Regular attention exercises can help you stay present and focus on the trading process.

- Set clear goals : create a clear understanding of your trade goals and risks tolerance to decision -making.

conclusion

The combination of knowledge, discipline and self -esteem requires the cryptocurrency trade with psychological insights. Understanding how emotions affect decisions and use methods, such as suspension regulations, risk management and news -based monitoring, you can develop more conscious strategies to navigate the cryptocurrency trade world.