Protect your investments in cryptocurrency: a portfolio safety guide

While the world of cryptocurrencies continues to grow and evolve, investors are becoming increasingly eager to undertake an action. With thousands of different cryptocurrencies available to invest, it could be overwhelming to know where to start. However, a crucial aspect of the cryptocurrency investment is the safety of the portfolio. A safe wallet can protect your investments from hackers, viruses and other harmful actors, allowing you to keep the parts safe and healthy.

What is a wallet?

A wallet is a digital storage system that allows users to archive, send and receive cryptocurrencies. It provides a safe environment to keep private keys, which are used to access cryptocurrency funds. A good wallet should be able to generate two two -factor authentication codes (2fa), which add a further level of safety to protect from unauthorized access.

types of wallets

There are different types of portfolios available, each with their own strengths and weaknesses. Some popular options include:

* Material wallets : these are physical devices that memorize the keys offline privately, which makes them highly safe. The examples include the Nano X book and the Trezor T.

* Software portfolios : these are digital applications that store private keys on a computer or mobile device. The famous software wallets include Myetherwallet and Metamask.

* paper wallet : these are paper documents that contain the private key, which makes them easy to bring with you.

How to protect your investments

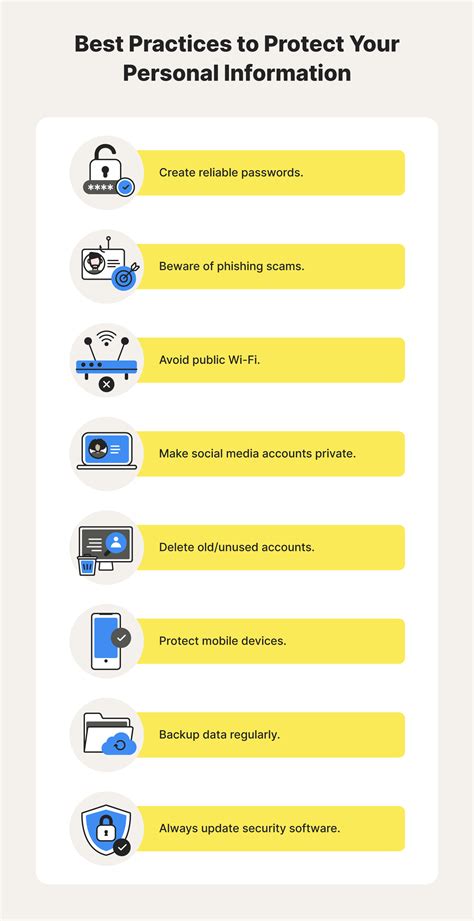

To protect your investments in cryptocurrency, follow these best practices:

- Choose a famous portfolio : Find and select a wallet from a renowned supplier. Search for wallets that have good safety notes, such as reviews 5 -star on Trustpilot or Reddit.

- Use two factors (2fa)

: activate 2fa codes to add an additional level of safety to the wallet. This can be done through SMS applications, authenticator or biometric authentication.

- Keep your private keys : never share private keys with anyone. Use a safe password manager and keep your wallet blocked by unauthorized access.

- Use strong passwords : Choose solid passwords for your wallet, as a combination of letters, figures and special characters in capital letters.

5

- Keep your software updated : Update your software and your wallet regularly to make sure you have the latest safety corrections.

- Pay attention to phishing scams: pay attention to phishing scams that claim to come from a company considered, asking for the identification of the connection or private keys.

Common security threats

To protect yourself from common security threats, keep in mind:

* Phishing fruits : Crooks will try to encourage you to reveal the identification information of the connection or private keys.

* malware : pirates can install malware on your wallet that allows them to access funds without authorization.

* Ransomware : Ransomware attacks can block the wallet and request a redemption for the key to decrystography.

Conclusion

The protection of investments in cryptocurrency requires attention to detail and commitment for safety. By choosing a famous portfolio, using 2fa codes, keeping private keys and following the best practices, you can minimize the risk of losing access to funds. Do not forget to remain alert against phishing scams, malware and ransomware attacks.

Additional resources

* Crypto-Mogarias

security guides: the Council’s blockchain has published a complete guide on the security of cryptocurrencies.

* Best Practice for the safety of the portfolio : consult our guide in -Profonde on the best portfolio safety practices for the best investment tips.