Stop Commands: A powerful tool for cryptocurrency investors

As the cryptocurrency world continues to increase, as well as the number of investors looking for ways to protect their investments. An effective strategy is the use of stop commands, a powerful tool that can help you avoid significant losses in case of market volatility or unexpected prices.

In this article, we will deepen in the world of stop orders and explore how they can be used to protect your investments in cryptocurrency.

What are the stops to stop?

A stop order is an automatic market order that instructs a broker to buy or sell a certain asset at a specific price level. The term “stop” refers to the point where the order will be executed, regardless of the market conditions. When performing a stop order, you are essentially counting your broker to monitor the market and execute trade as soon as it reaches that price.

How to use stops for cryptocurrency investments

To use stop commands effectively for cryptocurrency investments, follow the thesis steps:

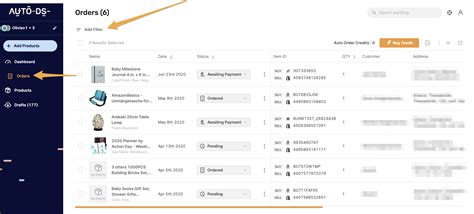

- Choose your Platform : Select a renowned cryptocurrency exchange or brokerage firm that sacrifices automatic trading capabilities.

- Set the price range : Determine the maximum and minimum price level for which you want to perform transactions. For example, if you invest in Bitcoin, set the stop order to 10,000 satoshies per unit (SPK) to block a profit if the price reaches this level.

- Choose the order type : Decide if you want a “market” stop order or a “order type” stop order (more about it later). Market stops are automatically executed based on market conditions, while order -type stops require manual intervention by your broker.

- Set a trigger price : Enter the price level at which you want to trigger a stop order.

Types of command:

There are two types of stop commands:

* Square stop order : Automatically executed based on market conditions, this type of order is suitable for long -term investors who want to overcome market fluctuations.

The order stop order (OTSO) : Requires manual intervention by your broker, OS stops are ideal for traders with a higher degree of market prices.

Benefits of using stop orders

Using Stop Commands Several Advantages:

- Reduced risk : By establishing specific price levels for which you are willing to buy or sell, stop orders help minimize potential losses in case of significant price drop.

- Increased discipline : Stop controls require discipline and patience, helping investors avoid impulsive emotions -based decisions, rather than the fundamental elements of the market.

- Improved trading performance : limiting exposure to extreme market conditions, stop commands can lead to better trading performance over time.

Common Papcans to Avoid

While the stops offers many advantages, there are a few common traps to pay attention to:

Over-Trading **: Set the stop orders too frequently or at low price levels and you may be forced to trading more than necessary.

* Insufficient price range : The failure to set a sufficient price range can lead to unnecessary market exposure.

* Lack of market awareness : Failure to comply with market conditions before placing a stop order can lead to weak decisions.

Conclusion

Stopping commands are a powerful tool that can help cryptocurrency investors to protect their investments and to better trading performance. By choosing the right platform, setting specific price intervals and selecting a type of order (market or OTO), you can capitalize on the benefits of stop orders and you can stay in front of the cryptocurrency world.

Remember, it is essential to understand the risks and rewards associated with the stop commands before using them. Make time to educate yourself about how to use the thesis tools and keep -always have the investment goals.