How to use trading indicators for market analysis

The cryptocurrency trade has increased new and exciting markets. However, with the information available to merchants, it may be overwhelming one of the stress -making stress is the use of trading indicators.

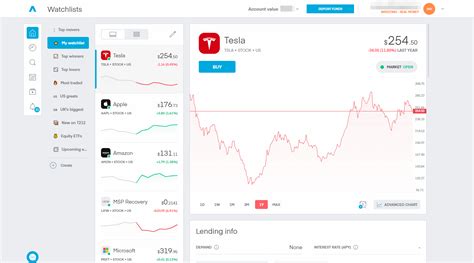

Trade indicators are graphic presentations on the price of cryptocurrency prices that provide merchants valuable views on market trends and possible profit areas. By analyzing these indicators, merchants can have a great and better understanding of the market and make more conscious decisions about which cryptocurrencies for the trade.

What are trading indicators?

Trade indicators are diagrams and charts with a variety of technical and fundamental metrics related to the price of cryptocurrency. These indicators

Some common trading indicators are:

.

* Bollinger lanes : a volatility-based indicator that shows prices on the centerline, indicating a support or resistance level.

* Moving Average Conference Time (MacD) : Vibrating line that compares the speed of the two Momentsum indicator over time.

Using Trade Indicators for Market Analysis

Analysis, merchants should follow these steps:

1.

2.

.

4

*

Benefits for the use of trade indicators

Using the trade indicators offers multiple benefits including:

* Improved decision -making : Analyzing indicator information merchants can make more conscious decisions on which cryptocurrencies in the trade.

* Increased accuracy

: Indicators can help identify patterns and trends that may not be obvious through manual analysis alone.

.

conclusion

Trade indicators are an effective tool for Market analysis, providing merchants valuable information on the price of cryptocurrency. By following cryptocurrencies in the shop. Any risks associated with any investment or trade strategy.

Other resources

* Trade Indicators Tutorials : Websites such as Crypto Trade Indicators and Trade Strategy Center Tutorials and Guides for Market Analysis for Trade Indicators.

* Books and Articles : John J.